Investments in new equipment and innovation in the ocean cluster are expected to reach an annual €100-170 million in the coming years. At the same time, the importance of entrepreneurship in the ocean cluster has met increased understanding. Untraditional marine-related industries have been growing and numerous new businesses have been established in marine biotechnology and advanced seafood processing. How will investments in the ocean cluster progress in the coming years and will emerging sectors continue to grow?

Investments in the ocean cluster can be sorted into four main categories. First, there is investment in new vessels that are built overseas but can lead to considerable domestic investments in technological equipment. Secondly there is investment in innovation and technology related to fishing and fish processing. Thirdly, there is investment in new processing methods and product development and lastly there is investment in marine biotechnology innovation such as the development of pharmaceuticals and supplements from marine raw materials.

Investments in new fishing vessels will add up to no less than €220 million in the next three years, most of which will occur in 2016. Currently 11 commercial fishing vessels are being built for Icelandic fisheries, eight wet-fish trawlers, two pelagic vessels and one freezer trawler. These ships are replacing a number of older and much less technologically advanced vessels, leading to substantial long-term cost reductions for the Icelandic fisheries industry as a whole.

€400 million turnover in the marine technology sector

According to our analyses, investments in technological equipment for fishing and fish processing have increased rapidly in recent years thanks to increased and more diverse land-based seafood processing as well as improved finances of fisheries. The Icelandic marine technology sector has an annual turnover of around €400 million, of which an estimated 20% or €80 million comes from domestic sales. Around half of that is assumed to be long-term investments, yielding around €40 million annually.

Investments in ships and equipment are different from other innovation investments in the marine industry in the sense that they are generally made by financially sound businesses with the aim of reducing costs and increasing efficiency. These sorts of investments are well known to financial institutions that hedge their capital with collateral in real estate, ships or equipment.

€35 million annually into new processing methods and product development

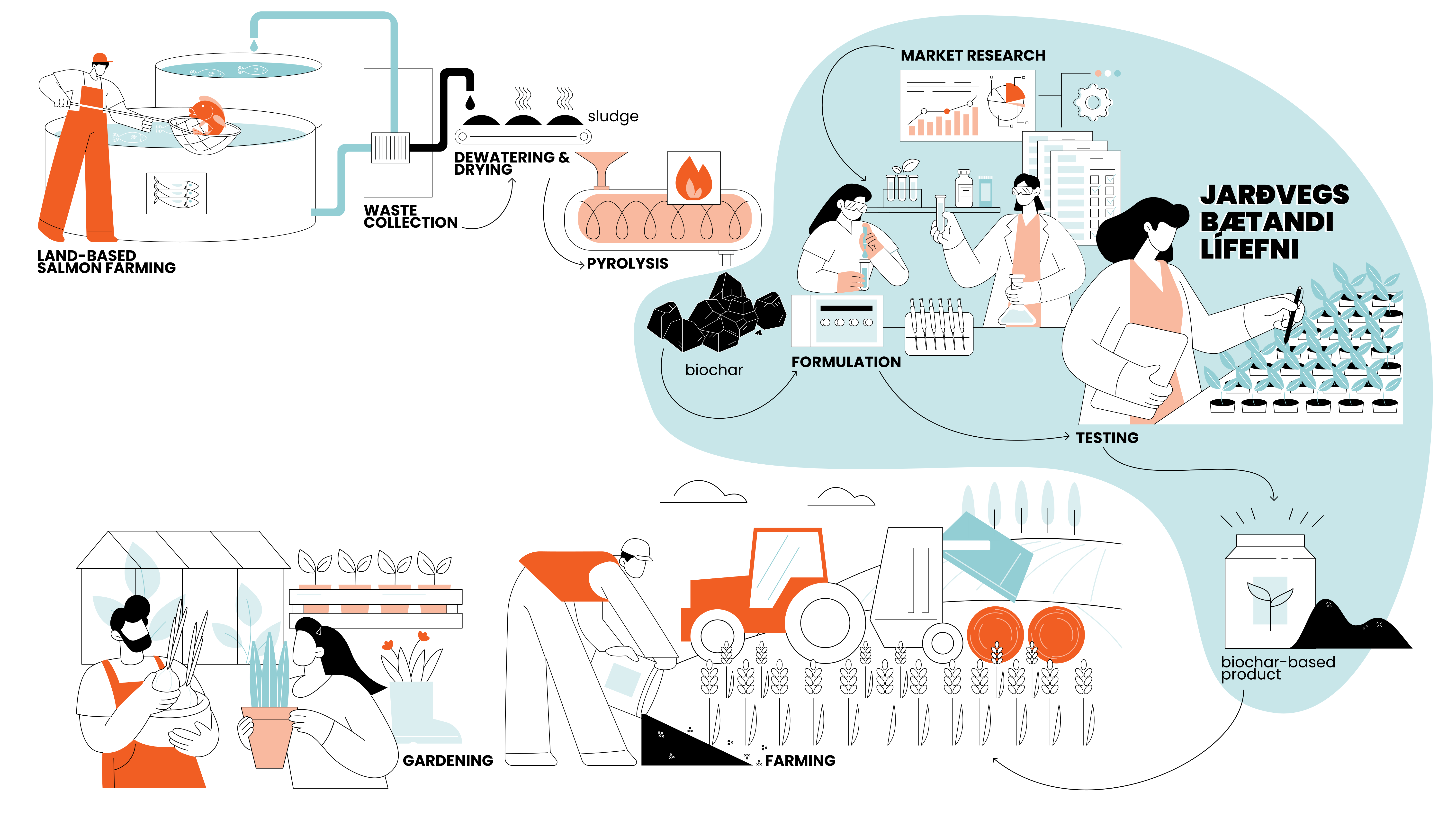

When it comes to innovation in processing and product development we estimate that the projects that have been presented recently call for an investment of €35 million each year for the next three years. The largest projects are new and expanded facilities for processing fish oil, algae, collagen, dried seafood, protein and canned products. Many of these projects involve new products and carry significant risk for investors. This is not true for the largest fish oil, canning and drying factories where markets have already been established and the technology has been proved.

One of the most interesting aspects of marine-related investments is the growth of investment in product development, especially in consumer products. Another very promising field is marine biotechnology, a field primarily based on people, knowledge and research as opposed to machines and large-scale factories. An estimated €15-27 million annual investment is expected to flow into these sectors in the next three years.

The need for increased knowledge on the investor side

According to projections for the global marine industry, biotechnology, rest-raw material utilization and advanced seafood processing are expected to experience substantial growth in the coming decades and parallel developments can be seen in Iceland. Nonetheless, funding for entrepreneurial activities in the marine sector has been unjustly difficult, in part due to lack of knowledge in new sectors on the investor side. Increased knowledge within the financing sector would be in the interest of both sides. Furthermore, the levels of venture capital in the ocean cluster in Iceland are suboptimal and promoting capital investment in the sectors that are most likely to create long-term value is the key to sustained economic growth.

______

For more information, contact us:

Bjarki Vigfusson, economist

Haukur Gestsson, economist

Thor Sigfusson, founder and CEO